50/30/20 budgeting rule of thumb

What is the 50/30/20 rule budgeting rule

One of the most important things in personal finance is to get intimate with your expenses and have a budget in place. And one of the simplest budgeting rules of thumb is the 50/30/20 system.

This post may contain affiliate links, please read our affiliate policy for more details.

Senator and Democratic presidential candidate Elizabeth Warren coined the 50/30/30 rule in her book “All Your Worth: The Ultimate Lifetime Money Plan.”

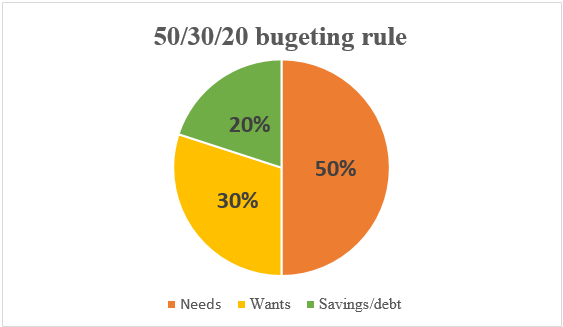

The basic premise of the rule is to divide your after-tax income into three categories: 50% needs, 30% wants, and 20% savings and/or paying off debts.

After-tax income

In the 50/30/20 budget system, the most important thing to know is your after-tax income. If you’ve been monitoring your pay stub then you should know exactly how much you’re getting paid each time.

According to The Balance, your after-tax income is what is left after all applicable taxes are taken out. Example deductions are state tax, local tax, income tax, Medicare, and Social Security.

Of note, healthcare, retirement contributions, and any other deductions will be needed to be added back to your paycheck because these are not taxes.

If you’re self-employed, then your after-tax income is the balance of gross income minus your business expenses plus the money you set aside for taxes.

50% “Needs” of the 50/30/20 rule

Needs are something you cannot live without such as food and shelter. In other words, life’s necessities, or things that can severely impact the quality of your life.

Examples of needs.

- grocery

- rent

- mortgage

- health insurance

- car payment

- utilities

- prescription medicine

According to the 50/30/20 rule, these “needs” expenditures cannot exceed 50% of your after-tax budget.

30% “Wants” 50/30/20 rule

Wants is the next category and you cannot exceed 30% of your budget in this category. They are something that can cause minor inconveniences for you but you can go without them.

Examples of wants.

- shopping (extra shoes, clothing)

- dining out

- hobbies

- fast internet

- unlimited data plan

- Netflix, Amazon Prime

- cable tv

This part is tricky because you have to figure out exactly what your “wants” are. For example, clothing is a “need” but the latest fashion trend and latest shoes are a “want”.

20% “Saving/retirement or paying off debts”

Savings/Paying off debts is self-explanatory, in this category you’re limited to 20% of your budget.

Remember that you need to set up an emergency fund of at least 6 to 12 months of expenses. Equally important, you need to set up a rainy day fund, this fund is more liquid and reserved for short term unexpected expenses.

Examples of savings/debts.

- credit cards bill

- student loans repayment

- retirement funds

- investment funds

Nerd Wallet has a free 50/30/20 calculator that you can use to figure out the after-tax monetary value that you have to work with.

Let’s say you bring home $3,000 a month in after-tax income. Inputting this number in the calculator would give you:

- $1,500 for needs

- $900 for wants

- $600 for savings/paying off debt

Debt avalanche versus debt snowball

Since I mentioned a little bit about the student loan and other debts, let’s discuss the two best methods to pay off your debts fast.

Debt avalanche and debt snowball are the two most popular ways to quickly pay off your debt. And I personally used both methods to pay off more than $188,000 in student loans.

Debt snowball (Dave Ramsey) system

In the debt snowball method, organize your debts in order of smallest to largest by dollar amount regardless of the interest rate.

For example, let’s say you have the following debts.

- credit card: $2,000

- auto loan: $20,000

- student loan: $160,000 *average pharmacist loan owed

The best way to apply the debt snowball method is to knock out one debt at a time and paying the minimum on the remaining debt.

Once the smallest debt is finished then combine the payments of what you would have used to for the first debt and pay off the second debt next.

Repeat this step until all of your debts are paid in full.

Debt avalanche

In this alternative method, list debts from highest to lowest interest rates

A good tool to use is debt reduction, spreadsheet calculator.

See the video below for a quick demonstration.

Watch the tutorial video above to see step-by-step instructions on how to use the spreadsheet.

One of the cool features of the Vertex42 debt reduction calculator is that you can choose either the debt snowball method or the debt avalanche as your preferred repayment plan.

After inputting all the needed data, the spreadsheet will populate a payment schedule for your convenience. Best of all, this tool is free to download.

Alternative budgeting system

Envelope budgeting system

You can call this method as an old-fashioned or old school budgeting system but it works, likely due to the psychological component.

The first step is to figure out the major expense categories that you want to focus on.

Then you’ll physically put money into labeled envelopes.

Each envelope is a different category of your choice.

Example: eating out, entertainment, gas and miscellaneous

For example, let’s say you decided that your budget for the above categories is this:

- eating out: $200

- entertainment: $100

- gas: $150

- miscellaneous: $50

For this crucial step, you need to understand your budget and how much money you need in each category.

Don’t know where to start? A good tool to use is Mint to track your budget since Mint will help categorize your expenses into different categories for you.

Alternatively, you can use google sheets to track your monthly expenses.

Every time you need to use the money for those categories, you just take the needed money out of the envelope.

When the envelope is empty, you’re not allowed to use any more money for that category.

What if you don’t like to carry the cash? You do not need to carry the envelopes everywhere you go.

You can certainly use your credit/debit for this purpose, take the cash out of the envelope and then charge your card. Afterward, deposit the money in your bank account.

The whole point of the envelope system is to force you to see your expenditures front and center.

Overall this cash envelope system work because it has a psychological component and forces your mind to registers the transaction every single time.

Final thoughts

In this post, I discussed two of the easiest to implement budgeting systems via the 50/30/20 budget rule of thumb and the envelope budgeting system.

I also briefly discussed my two favorite debt reduction methods: the debt snowball and debt avalanche.

This is all nice and good if you commit yourself to a budget and stay the course. What if you don’t like either of these systems?

Fortunately, there are apps and tools out there that help you with this.

Mint.com is my favorite and I have been using this app for a very long time. When you link all your accounts such as credit cards, and banks, you’ll get a good picture of where your money is going.

You Need a Budget is not free, it cost $6,99 a month but I have heard of good things about from some of the podcasts that I’ve been listening to.

Personal Capital (free, has budgeting features but more useful for investing and checking your net worth.

The bottom line is, you need to be mindful of where your money is going. That way, you can track where you spend the most money on and see if it is something that you can cut back and save some money.

Good luck!

Pingback: Average net worth by age and August 2019 update - Pharmacist Money Blog

Pingback: How to Get Rich Slowly as a Pharmacist - Pharmacist Money Blog