Don’t be a pharmacist HENRY!

What is HENRY?

High earner, not rich yet (HENRY) is a term a came across with reading an article. Investopedia states that a 2003 Fortune Magazine article defined families earning between $250,000 and $500,00, but don’t have much to show for it after taxes and costs of living.

This term is applicable to professionals such as lawyers, doctors, dentists, and pharmacists. The reason HENRYs are the way they are is that their earnings are covering debts and other costs rather than into wealth-building activities such as investments.

In other words, they are the “working rich,” for example, pharmacists will lose their comfortable lifestyle if they quit working.

Since the original definition referenced above, HENRYs are mostly defined as millennials, who earn between $100,000 to $250,000 but feel broke.

These modern HENRYs are guilty of lifestyle inflation, combined with high student-debt burden and costs of living, are forced to live paycheck to paycheck.

How to stop being a HENRY?

I don’t think pharmacist HENRYs are uncommon. It’s okay that you fall into the definition of this acronym. It doesn’t matter how you ended up as a HENRY. The most important question is, how can I stop being a pharmacist HENRY?

The student planner laid out a good plan for you here:

- Choose a pharmacy school that is affordable

- Choose a high-paying pharmacist job

- Pick a good loan repayment strategy and pay off your student loan and find other ways to reduce your liabilities

- Increase your savings rate

Other ways to stop:

- Track your spending

- Reduce expenses and cut costs such as avoid buying an expensive car or other luxury items

- Find a side hustle or other ways to boost your income

- Increase and grow your assets such as maximize retirement contributions

- Get professional help if you need it

One of the most important factors mentioned above is your savings rate.

For demonstration purposes, let’s use the networthify calculator to see when you can retire.

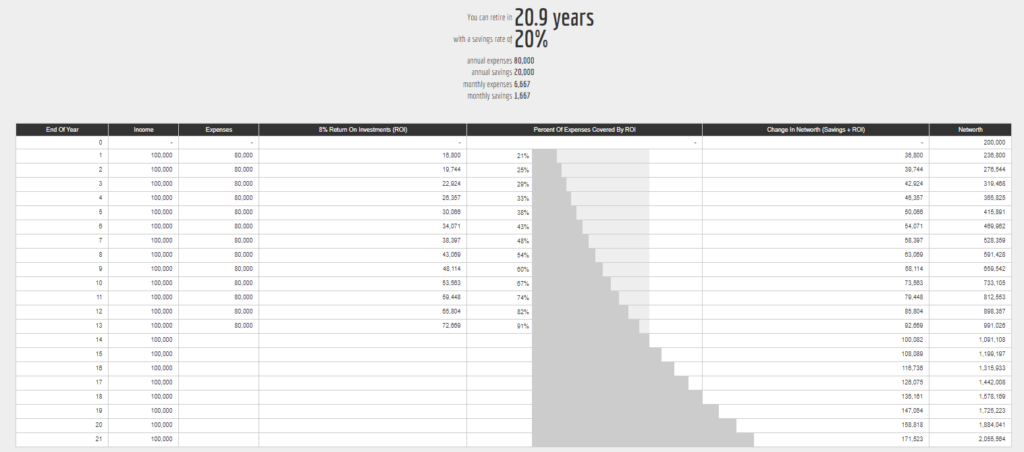

Let assume that your pharmacist take-home pay is $100,000 and your annual savings are $20,000 and your current expenses are $80,000. Your effective savings rate is 20% and you have an investment portfolio is $200,000. Assuming an 8 percent annual return on investment, using the 4 percent withdrawal rate.

This screen shot is hard to see but at 20% savings rate you’re looking at 20 years until retirement with our assumptions.

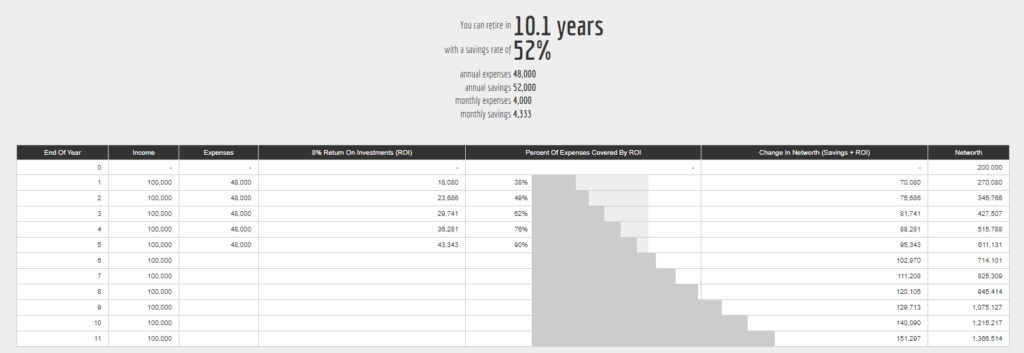

Now, 20 percent savings rate is respectable. What if you’re able to increase your savings rate to 52%?

As you can see above, increasing your savings rate from 20% to 52% decrease your time to retirement by half. Of course, a 50% plus savings rate is hard to keep with but this is exactly what FIRE adherents are aiming for with the dream of financial independence and/or retire early.

Take Away Points

It is extremely easy to fall into the spending trap of being a high earning professional. Pharmacists are not an exception. It takes discipline and determination to pay off your student loan and other debts throughout your pharmacist career. Although the acronym HENRY can be used as a marketing ploy to target high earning millennials.

It is important to point out that lifestyle inflation can delay your chances of building wealth and retire comfortably.

The playbook makes sense to me. Enroll in the most affordable PharmD program, find a high paying job, pay off your student loan debt.

Preferably putting off making big purchases at this time to concentrate on paying off your student loan. The mantra that I like a lot is live like a pharmacy resident (if you ever went to a pharmacy residency) or live like a pharmacy student if you didn’t.

Track your spending and find appropriate ways to cut back unnecessary expenses to boost your savings rate. Maximize your retirement accounts and then grow your assets further by investing in a brokerage account.

Keep your investing fees low and returns of investing high by investing in index funds.

Engage in a side hustle or other pharmacy related gigs to boost your income. Essentially, what I am asking you to do is be a rich pharmacist instead of a pharmacist HENRY!