How to Invest Money Wisely

Step by Step on How to Invest Your Money

This post may contain affiliate links, please read our affiliate policy for more details.

In the post, I will show you exactly how to invest money in seven steps. Starting with the lowest risk and progressing to higher risk forms of investment.

How to invest Money Step 1: Low-Risk Investment

Here, you’re looking for a basic place to put your money. The number one choice among many personal finance bloggers is Ally Bank online savings account.

Ally Bank or any other high-yield savings account give you at least 2% interest rate on your money.

Setting up an account is really simple, easy and fast. I personally have a Sofi Money account. It literally took me 5 minutes to sign up for an account, deposit money and you’re done.

Ally Alternatives

Sofi is currently offering a better interest rate than Ally at the moment with 2.25% APY.

The one advantage that Ally has over Sofi Money is automation. As of right now, I haven’t found a way to automatically contribute money to Sofi.

Sofi only allows direct deposit or manual money transfers. Another downside to these high-yield savings account is that its’ interest rates are variable. Meaning, they reserve the right to increase or decrease their interest offering at a moment’s notice.

An alternative online savings account you can choose is Wealthfront Cash, currently offering a 2.57% APY. I started using Personal Capital to track my investment recently and I saw that they just started a new high-yield savings service offering a 2.30% interest rate.

A high yield savings account is recommended for short term funds such as an emergency fund, saving for a down payment on a property, etc. These are the type of funds you may need in five years or so and you want it to be easily accessible.

Why don’t you want to invest this money in the market? Because in reality, in the short term, the market may be too volatile for you to guarantee any sort of profit. Basically, we don’t know where the markets will be five years from now. You can actually end up losing money in this case.

The best recommendation is to put that money in online savings account that will guarantee at least a 2% return on your money with absolutely no work, no risk and you just simply sit back, relax and call it a day.

In my opinion, aside from online savings account certificates of deposits is also a low risk investment. You’re guaranteed certain return over time.

Certificates of Deposits

A certificate of deposit (CD) is a savings certificate with a fixed maturity date and specified fixed interest rate that can be issued in any denomination aside from minimum investment requirements. A CD restricts access to the funds until the maturity date of the investment.

Investopedia

A CD is another example of a low-risk investment. According to Bankrate, the current CD of 6 months to 5 years ranges from 0.60% to 3.10% interest dependent on which bank you’re going with. Although it is not high, you’re for sure getting a guaranteed return of your investment.

Instead of buying a one time CD, you can set up a CD ladder where your funds will continuously mature, allowing you access to the funds or continue to reinvest in CDs with terms of 1 year, 2 years, 3 years, 4 year and 5-year terms.

How to Invest Money Step 2: Roth IRA

If you haven’t already done so, go ahead and open a Roth IRA account. Setting up a Roth IRA is just as important as the personal finance advice of opening a credit card to build your credit.

Roth IRA is a retirement account that you can put money in and after the age of 59 1/2 years old you can pull out all of your profit completely tax-free without paying any capital gains tax.

Prior to 59 1/2, you can pull out whatever money you contributed to that account but whatever profit you made from that money must remain in there, otherwise, you end up paying a penalty.

For example, if you put in $6,000 (2019 max limit) to a Roth IRA and it grows to $8,000, you can pull out that original $6,000 at any time but that extra $2,000 profit must remain in the account. Otherwise, you will have to pay taxes on that money as well as paying an additional 10% fee.

It’s not worth it, so I don’t recommend pulling out your money until you’re at least 59 1/2 years old.

There’s something to clear up at this point, Roth IRA is not the investment itself, it is simply just a retirement account for you to hold your investment within. Just imagine this is almost like a brokerage account. With this account, you can invest in stocks, index funds, and bonds or even real estate.

Roth IRA is ideal for a young millennial who is not making a ton of money right now.

Roth IRA benefits for young professionals

- You’re already in a low tax bracket

- Decades of compound interest

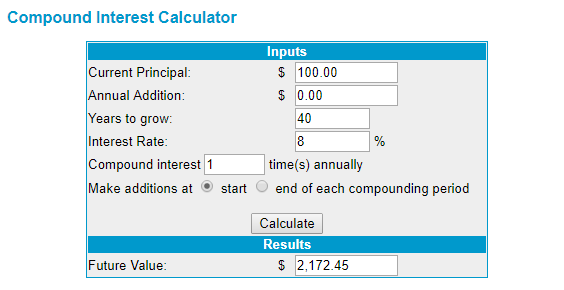

The power of compound interest

As you can see from the above example if you put in $100 when you’re 20 years old, in 40 years you could potentially have $2,172.45. If you chose to invest in a traditional IRA, you’d have to pay tax on $2,072.45 profit you made. In Roth IRA, you will pay no tax on that profit.

Investing money in a Roth IRA as soon as possible is probably the best investment decision you can make right now. Your future self will thank you for it.

How to Invest Your Money Step 3: Index Funds (Medium Risk)

What do you want to invest in? The biggest recommendation for most people is to invest in an index fund with a low expense ratio.

The majority of investors and even hedge funds managers cannot consistently beat the market so instead of beating the market it’s best to ride the market and invest in the whole market.

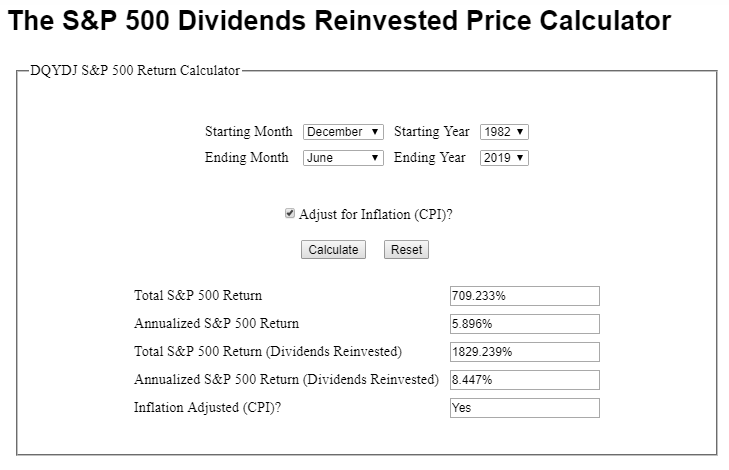

You can see from the image above that historically, the S&P 500 will yield a 8.4% annualized return, even after adjusted for inflation.

For this reason, for most people, this is the safest, highest-yielding long-term investment out there besides real estate. When you invest in an index fund, however, you may have to pay a small fee.

In fact, Warren Buffett, a highly regarded investor remains bullish on index funds investing.

Therefore, it is crucial when you decided to invest in something like this, you choose the cheapest fund you possibly can to minimize fees and optimize your return of investment.

The go-to index fund for most investors is Vanguard, featuring an expense ratio of 0.04%. According to Vanguard, this is 96% lower than the average expense ratio of funds with similar holdings. You can think of alternatives like Findelity, Charles Schwab, and TD Ameritrade.

What is an index fund?

It is a fund that comprises of hundreds or thousands of different companies. You can own a fraction of all of them for a fairly low price. That is the gist of what an index fund is. It give you the ultimate diversification for a very low price.

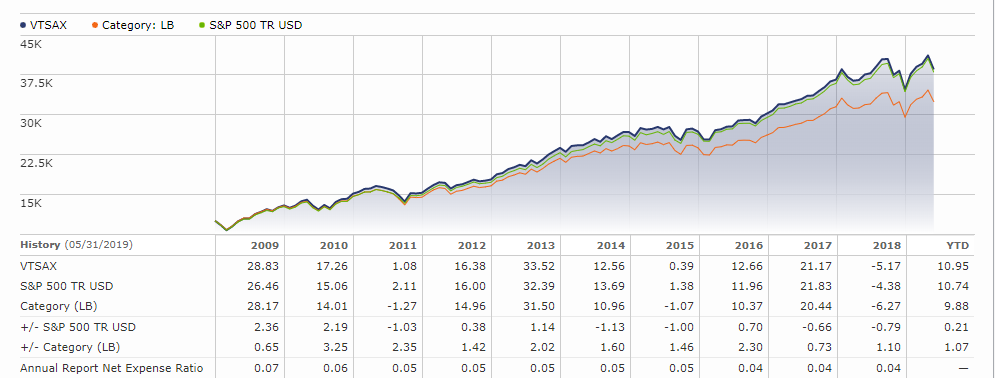

The most well known Vanguard Index Funds in the personal finance circle is the VTSAX. This is the total stock market index fund that comprises the entire US equities market.

As of this writing, the current price per share is $72.12. There is a minimum investment of $3,000 however. What about its performance?

The performance chart above shows VTSAX charting closely with the S&P 500’s performance, remember that the historical S&P 500 performance is at least 8 percent. As such, we should expect the same return for the VTSAX index fund.

Now, this is not to say the market doesn’t go down in the short term, and it’s very well possible. But remember this is a long term investment and hold this investment long term should net you a positive outcome.

VTSAX alternatives

Another good Vanguard index fund is called VFIAX. This fund covers the top 500 companies in the United States. The returns are similar to that of VTSAX. Specifically, since inception, this fund had a 6.5% return and over the last ten years, the return was 12%.

Another way to invest your money with Vanguard is to do a target date fund. This basically takes the guesswork out of the equation. Instead, you will figure out which year you’re going to retire and the fund will do the rest of the work for you.

This latter option is good for those investors who has a “set it and forget it” mentality.

Although I recommend and will invest in index funds myself, there are other alternative forms of investment that are similar to index funds.

Mutual Funds

A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. The combined holdings of the mutual fund are known as its portfolio. Investors buy shares in mutual funds.

Investor.gov

According to some sources, you can potentially get upwards of 12% return of your investment from a mutual fund. However, the downside to mutual funds is their fees. According to Investopedia, mutual funds average from 0.5% to 1% and can go as high as 2.5%. Yikes!

Health Savings Account (HSA)

You can think of HSA as another form of mutual funds. In a nutshell, HSA is a tax-advantaged retirement fund you can set aside to take care of health care related expenses.

Things to consider before signing up for a HSA:

- Must enroll in a high deductible plan, i.e. more than $1,500 per year

- If your balance exceeds $2,000 then you can invest in a mutual fund of your choice

- 2019 limit for a single contributor is $3,500 and $7,000 for a family

- After the age of 65, you can withdraw penalty free for any reason

- In order to be both tax-free and penalty-free, the distribution must be for a qualified medical expense

- There’s a 20% penalty in addition to taxes if you decide to withdraw money for non-medical reasons

Triple tax advantage:

- Contributions a tax-deductible, helping you reduce your taxable income

- Assets in your HSA grow tax-free

- Funds can be withdrawn tax-free for eligible medical expenses.

Robo-Advisors

Betterment is a company I’ve been with since 2012 and I think they are good for beginner investors to get their feet wet with investing. For myself personally, they’ve given me an annualized return of around 8%. Read my full review here.

How to Invest Money Step 4: Traditional 401 (k)

In a nutshell, traditional 401 (k) is the money that you contribute that is deducted from your taxable income. In other words, you’re investing your pre-tax dollars and at the same time lowering your taxable income.

For example, your salary is $50,000 and you invested $10,000 to 401 (k). Since you deducted that $10,000 you’re only taxed as though you only made $40,000.

However, the catch here is that you will have to pay tax after the age of 59 and a half. Subsequently, you cannot withdraw money from this account before age 59 and half without a 10% penalty.

Another perk for the traditional 401 (k) is that most employer offer an employer match. This means your employer will match your contribution up to a certain amount.

In 2019, the average employer match is 5%, the maximum limit for contributions is $19,000.

This brings us to another VERY important point. Whatever the company match is, be sure to contribute to your 401 (k) to at least qualify for the employer contribution. If not, you’re essentially leaving money on the table. In other words, it’s free money.

How to invest money Step 5: Individual Stocks

This option is reserved for those that don’t mind getting into the trenches and do the work yourself. In essence, this is active investing. It is recommended that you invest in individual stocks using funds from an IRA or 401 (k) to avoid being taxed in whatever profit you may get.

In picking individual stocks you have the flexibility of choosing which companies to invest in. However, due to the nature of the business, their stocks fluctuate up and down and therefore, there’s more risks involved.

You may have a higher chance of losing more money this way. So this must be a risk you’re willing to take.

Keep in mind that when investing in an individual stock, it’s a lot riskier and you have less diversification. If the stock goes down, you may be losing a lot more money. But if you have the knack for this and enjoy keeping up with the stock market news you may get lucky and ended up picking winning stocks.

One important thing to keep in mind is that the average investor cannot consistently beat the market with individual socks. And it may be better for the “average” investor to stick to investing with an index fund.

By now you have probably figured out that I am an index fund fan and especially Vanguard. My affinity from Vanguard stems from the fact that they were the previous administrator of my 401 (k) fund. For that reason, I’m familiar with their user interface. They are also a non-profit organization and they offer one of the lower expense ratios in the industry.

Step 6: Real Estate

Unfortunately, this type of investment requires working capital. You may need to save money before you can make a move with real estate investment.

Typically, you may need 15 to 20% down payment to begin investing. Although it is better to have 20% so you can avoid the private mortgage insurance fee every month. And if you live in a high cost area like California, then you need to save up a lot more money.

Here at the pros of real estate investment

- Great cashflow

This means every month when rent is paid you get a check in your pocket

- Tax deductions

Because of all of the tax deductions afforded to you as a real estate investor, you may end up paying no taxes on your profits.

- Borrow Money

After the initial capital up front, you may borrow money from lenders and other investors and slowly pay that off over time.

- Building Equity

You’re building up equity in the property as you’re paying down the loan and then eventually after 15 to 20 years, you’re going to own that property outright.

- Appreciation

Over the long term, your property are likely to go up in value that’s why it’s no surprise that 90% of the world’s millionaires are created by investing in real estate.

Real estate investment does not need to be a physical property investment. There are three more ways you can invest in real estate without owning physical property.

- Real Estate Investment Trust

- Real Estate Crowdfunding

- Real Estate Syndication

Real Estate Investment Trust (REIT)

REIT is similar is to a mutual fund. There are many forms of REITs out there, focusing on residential or commercial properties. Furthermore, there are REITs that focus one sole industry such as healthcare for example.

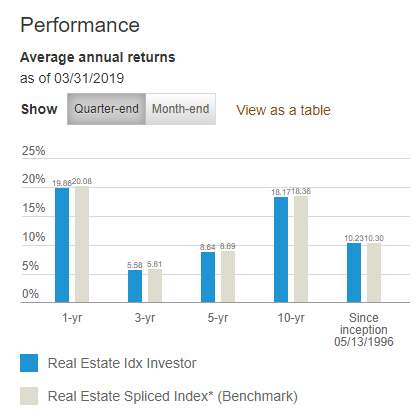

However, I recommend you stick to our theme of index funds investing and go with Vanguard’s VGSLX. You can think of the Vanguard Real Estate Index Fund as the same as the VTSAX index fund. The only difference is instead of having a share of all the stocks, the REIT will have a share of different kinds of real estate funds.

This fund invests in real estate investment trusts—companies that purchase office buildings, hotels, and other real estate property. REITs have often performed differently than stocks and bonds, so this fund may offer some diversification to a portfolio already made up of stocks and bonds. The fund may distribute dividend income higher than other funds, but it is not without risk. One of the fund’s primary risks is its narrow scope since it invests solely within the real estate industry and may be more volatile than more broadly diversified stock funds.

Vanguard

As you can see from the above image, VGIX’s return of investment since inception is around 10%. While in 2019, the rate of return is 19%. Overall, the REIT Index Fund can be used to diversify your investment, especially during volatile stock market times. However, their only weakness is that the focus is too narrow compared to a total stock index fund such as VTSAX.

Real Estate Crowdfunding

Real estate crowdfunding is the newest type of real estate available to real estate investors. This type of investment offer investors the flexibility to select their own individualized projects and portfolio. This new type of investment allow small investor access to closed off sectors like commercial real estate due to upfront investment costs.

Read this article from US News to find out more about REIT versus Real Estate Crowdfunding.

Real Estate Syndication

This investment method is similar to Real Estate Crowdfunding in that a group of real estate investors will pool their money together to invest in a multi-family project. In this case, a syndicator or a sponsor will take charge of the project like finding a suitable location, setting up contractors, etc. The investors will be paid a share of the profit when the project is completed.

The downside to both Real Estate Crowdfunding and Syndication is that these projects can take many years to reach maturity and your money is held up until then. There are some wriggle rooms but dependent on the project or the contract you’re basically on the hook until your deal expire, which can last up from 6 to 12 months or even 7 to 10 years.

Step 7: Invest in a Business

This investment has the highest risk but along with the highest risk there comes with higher rewards. Rich Dad recommended forming a business as a key to be rich and successful.

There are tax benefits and the potential for business failure. In a future post, I may explore the pro and cons of a franchise business, especially focusing on franchises that doesn’t require a lot of capital so stay tuned.

Final Thoughts

There you have it, the 7 steps on how to invest money. Let’s recap, in this post, I discussed 7 steps to investing.

- Low-risk investment

- Roth IRA

- Index Funds

- Traditional 401 (k)

- Individual Stocks

- Real Estate

- Business

I have already maxed out my 401 (k) contribution for this year and I am currently saving $6,000 so that I can open a Backdoor Roth IRA with Vanguard. After the Roth IRA conversion is completed, I will then invest in index funds. I hope this post was useful for you.

When it comes to how to invest your money, your investing should be tailored to your current situation and risk tolerance. However, the main thing is to start today and happy investing.

Pingback: Vanguard Index Funds Strategy - Pharmacist Money Blog

Pingback: Average 401k balance by age - Pharmacist Money Blog

Pingback: 7 Types of Income Streams - Pharmacist Money Blog