I paid off my student loan in 2 years

In this post, I will document my student loan journey and how I paid off my student loan in 2 years.

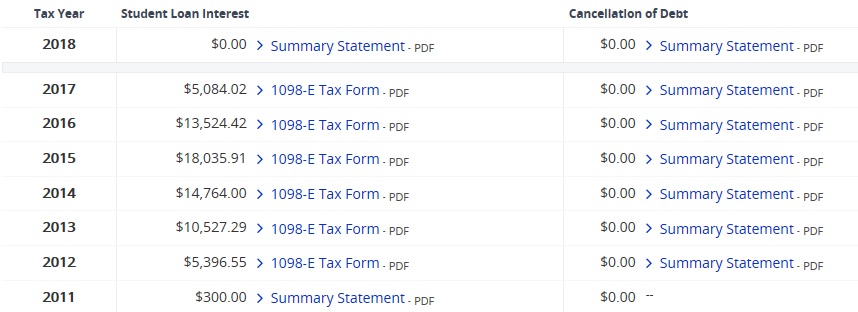

MyFed Loan accounts

Many college graduates are familiar with this loan servicer. My initial loan started with approximately $29,000 subsidized loan after my graduation in 2006. Student loans are usually subdivided into three different types of loans.

After my undergraduate studies, I enrolled in pharmacy school and graduated with a doctorate of pharmacy in 2011 with an additional $150,000 in student loans. Thanks to compounded interests, my total student loan ballooned to $188,000 upon graduation.

For comparison, another pharmacy acquaintance of mine owed around $179,000 in 2016. Another co-worker once told me she owed $250,000 because she graduated from a private pharmacy school.

Due to my wife’s job, we moved to a small town in Texas that didn’t have a lot of job openings. I didn’t start my first job until 2012 on an as-needed basis. This is when I was newly married. We had just purchased our first SUV, had a mortgage and a bundle of joy.

With all of our obligations and low income, I wasn’t able to pay off as much as I’d like. In order to have some breathing room, I decided to change the term of my repayment plan from the standard 10 years to the extended 25 years repayment schedule.

During this time I was trying out Dave Ramsey’s debt snowball method, I focused on paying off the smallest account I had.

Occasionally, I switched it up and tried the debt avalanche method in which I concentrated all of my available funds toward the accounts with the highest interests.

I was finally able to find full-time work in 2013. I don’t remember exactly when, but I eventually changed my repayment schedule to the standard 10 years term. This is when I was beginning to make a dent and heading toward my debt-free goals.

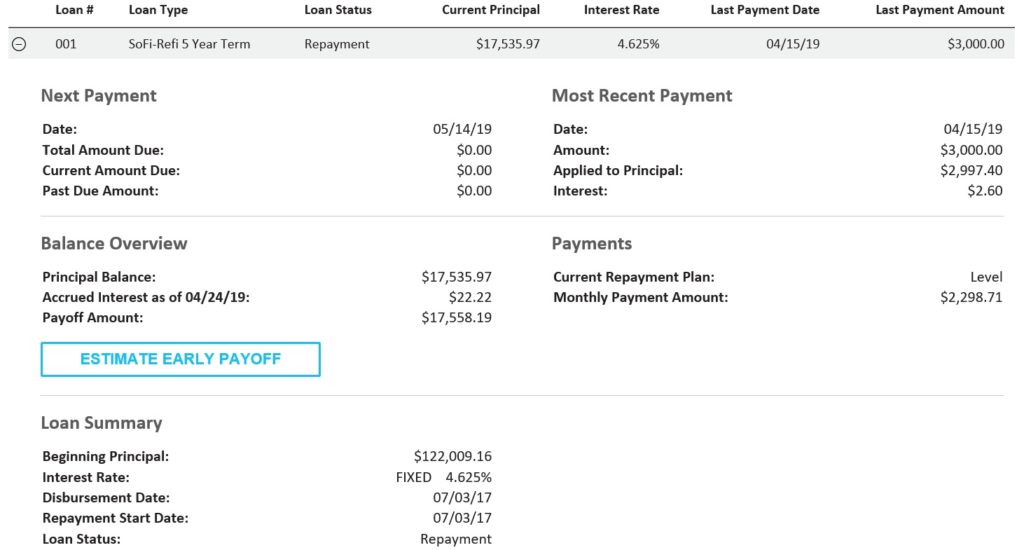

Lets fast forward to July 2017. I decided to seriously focus on my loans repayment. My remaining balance at this point is approximately $122,000 dollars.

Refinance with Sofi

This post may contain affiliate links, please read our affiliate policy for more details.

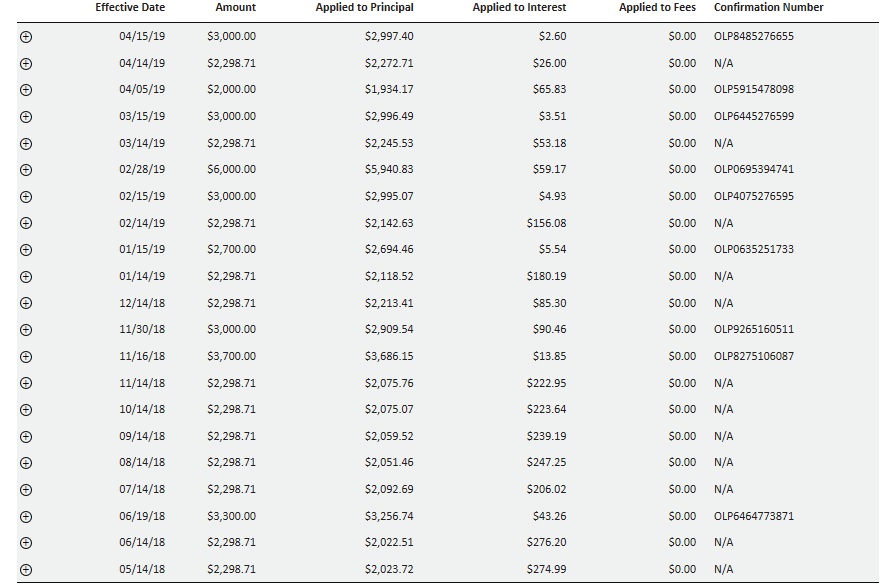

After some research, I determined that Sofi is the finalist to refinance my student loans. I had a good credit score (in the 800s) so I was able to secure a 5 year fixed rate loan with an APR of 4.65%. I had a monthly payment of $2,300. Determined to reduce the 5-year term, in addition to the required monthly, I was able to make extra payments.

As of this writing, I am happy to report that my balance is only around $17,500. I plan on being in student loan free status at the end of July 2019.

How did I do it? Since January 2019, I and my wife decided to only live off of her salary. This is one of the pros of having two sources of income. In addition to my monthly payment of $2,300, I was making another extra payment of $3,000 the day after ensure most of my payment will go toward the principal and not the interest.

Disclaimer, I am privileged to earn a six-figure salary but this didn’t come easy. I will write more about ways we are cutting costs in another post. If you’re interested in refinancing with Sofi please consider helping me out by using the affiliate link below to sign up. You’ll get a $100 signing bonus!

I thought Sofi gave me a reasonable interest rate compared to what I was paying before I refinanced my loan. My original interest ranged from 6.8% to 8.5%!

Check out this page for more refinance options.

Costs Cutting Measures

Cut the Cord

One of the main reasons I was able to focus on my student loans is that we’re able to cut costs on a few things.

One of which is to cancel DirecTv cable service. I was paying around $160 a month for cable. I didn’t really watch much of cable and the cost is not justifiable.

Nowadays there are many online options to choose from. I have tried SlingTV and Hulu plus Live TV for my tv fix. I only pay for what I use. If I wanted to watch the NBA finals or the SuperBowl I’ll just pay for those periods only and go without cable for the rest of the time.

Additionally, there are a plethora of free online streaming options out there. You can give Pluto TV a try, they have an array of options to choose from.

Roku recently added The Roku Channel with the offering that is similar to Pluto TV.

Another similar service was introduced recently from Amazon called IMDB Freedive.

All three of these free online platforms offer news, movies, and sports for you to choose from. And if you’re adventurous, I’d recommend getting yourself an Amazon Fire TV stick and install Kodi,

You can search the web for Kodi and you’d get plenty of guides on how to “properly” install Kodi onto your FireStick.

Packing Lunch

I am not proposing anything new here but one of the most effective saving is to skip going out to lunch and pack your own lunch. A fast-food meal can easily cost from $10 to $20 and these monies add up over time.

Skipping Starbucks

I’m not a big fan of Starbucks anyways so this habit was easy for me to cut out. A grande caramel frappuccino cost $5 dollars and over time can add up as well.

Saving money at the pump

I signed up for Shell Fuel Rewards (FR) if you get the gold status you get 5 cents off per gallon up to 20 gallons. However, this is not the main reason I signed up for FR. If you’re a T-Mobile customer like me, you can download the T-Mobile Tuesday app. They normally have their weekly 10 cents off for Shell deal and I’d snatch that up every week. Altogether netting myself 15 cents per gallon at the time weekly.

Skipping the Movie theater

Thanks to Kodi and other free online streaming services, we have a decreased need to go to the movie theater. We only go when there’s a big release or a must-see movie.

Skipping the Mall

We made a conscious effort to do less shopping for clothes and wear the ones we already have. Occasional shopping is okay but frequently going to the mall can make a dent in our budget.

Decrease eating out

Eating out is expensive, there’s no doubt about it. We now only go out to eat on special occasions. Such as celebrating being debt-free for example!

Coupon Clipping

I always ignore those pesky coupons sent to our home. But guess what? Using them more doesn’t hurt.

I paid off my student loan on 7/17/19

It is with great joy that I can declare that I am debt free from my student loan as of today. I made my last payment toward the Sofi account and the feeling is incredible!

I can finally move on with my life and crush more debts!

Pingback: Saving and investment strategy in 2019 - Pharmacist Money

Pingback: How Much Money is Considered Wealthy? - Pharmacist vs Money

Pingback: What’s my Net Worth in May 2019? - Pharmacist Money

Pingback: My 7-year Experience with Betterment - Pharmacist Money