Student Loan Strategy and Guide

One of the reasons for me to create this blog is to reflect on my student loan repayment journey and empower fellow pharmacists to do the same. These are the key tips I’d like to share with you and hopefully you can use it to fast-track your student loans repayment plan.

I started my student loan repayment with approximately $188,000! I still have around $17,000 but I am making a significant progress toward my goal of student debt free. Along the way, I’ve learned a few thing or two about student loan and hopefully by sharing them, I can help set you on the right track.

Things to consider:

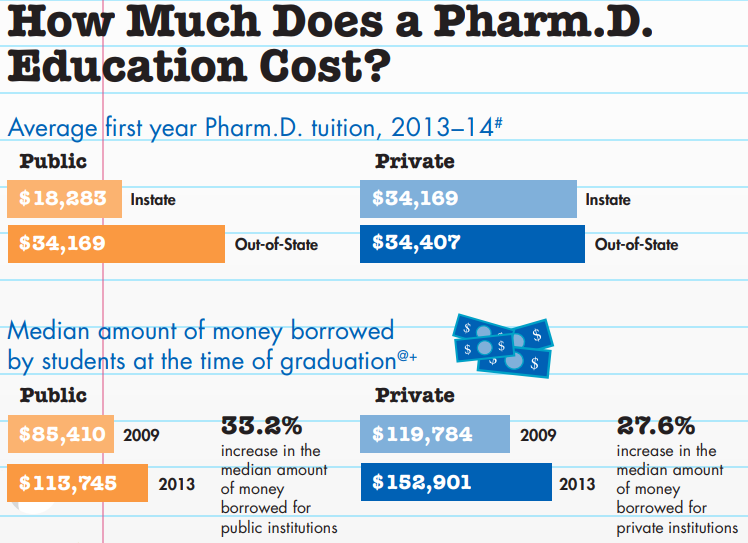

One of the factor contributing to your overall loan owed is whether you graduated from a private or public pharmacy school. If you look at the numbers from the chart above, pharmacy graduates from a private school may owe as much as $152,901 compared to $113,745 for public pharmacy school grads.

The class of 2020 owes an average of $179,514 in pharmacy student loan, $213,090 for private colleges and $147,938 at public schools respectively.

Another possible culprit to your total loans owed is the money you borrowed from your undergraduate studies. Your undergraduate loans will be deferred during pharmacy school but you’ll have to start paying back all loans 6 months after graduation, known as the “grace period.”

Early Strategy:

I know pharmacy school is rigorous but I’ve known a few classmates that can handle the course load and decided to work part-time as a pharmacy technician or intern. Extra earnings from your part-time job can offset some of your financial needs and allowed you to borrow less money.

If you can afford to, put in some of that extra earnings toward your loan principal. You’re underestimating the power of compounded interest on the total amount you ended with at the end.

One way to lower your loan burden is to secure pharmacy scholarships. There are scholarships based on merits and scholarships based on needs. Make sure you do your research and take advantage of these offerings.

I knew of a classmate who didn’t owe any money at all because she borrowed money from her family. If this option is available to you TAKE it and FORGET about student loans. You pay back your family later interest free!

Now that you graduated from pharmacy school and got your first job, it’s time to consider all the options available at your disposable and pick the best repayment plan for yourself.

Consolidate your loans:

Loan consolidation allows you combine all your loans into one payment at a fixed interest. The consolidated interest is an average of your various different rates from your loans. As with anything in life, consider the pros and cons with loan consolidation before deciding if it’s right for you.

Pros:

- Simplify your loans from different loan servicers into one monthly bill

- Lower your monthly payment by paying a longer period of time (up to 30 years)

- Access to Public Service Loan Forgiveness (PSLF) and income-driven repayment plans

- Change variable rate loans to fixed rate

Cons:

- Because of the longer repayment period, you will have to pay more in interests

- Outstanding interest from your loans will be added to your principal after consolidation

- If you are already under an income-driven repayment plan or PSLF then you will lose payment credits for these programs

Choosing a payment plan:

There are numerous repayment options for you but the 2 best ones are:

- Standard repayment of 10 years

- Income-driven repayments

The standard repayment plan will allow you to pay the least amount of interest compared to the other repayment options.

If you cannot afford to pay the standard repayment plan, then income-based repayment (IBR) is the best option for you. This repayment plan requires you to pay 10 to 20% of your discretionary income,

Discretionary income is how much money you have left after paying taxes and other necessary expenses like food and shelter.

There are four different kinds of income-based repayment plans:

- Revised Pay As You Earn Repayment Plan (REPAYE Plan)

- Pay As You Earn Repayment Plan (PAYE Plan)

- Income-Based Repayment Plan (IBR Plan)

- Income-Contingent Repayment Plan (ICR Plan)

Enroll in a loan forgiveness program:

Also known as Public Service Loan Forgiveness (PSLF) program.

PSLF is a federal program offered to certain government and nonprofit employees. Under the program, your loan will be forgiven if you make 120 qualifying payments. After that the remaining balance will be forgiven tax-free.

If you qualify for PSLF then the best repayment plan is income-driven repayment. The reason being if you are enrolled in a PSLF plan and are in the standard repayment plan, you would have paid off your loans before you qualify for loan forgiveness.

Consider refinancing your loans:

With pharmacists earning on average of over $126,000, you’ll qualify for refinancing, especially from a private lender. Refinancing your loans can help you pay less over the life of your loan due to the reduced interest rate. Find out how I paid off my student loans via refinancing here.

However, before deciding to refinance your loans, you must understand that you’re no longer eligible for programs such as PSLF, income-driven repayment plans, deferment, and forbearance.

Once you refinance your loans, you can actually go for a second refinance. The reason for refinancing again is that you can lower your interest rate even further.

Ready to refinance your loans today?

I created a page dedicated to student refinance here.

Boost your income and other strategies:

Regardless of which repayment plan you pick, it’s best to maximize your income so you can better focus on paying off your loans. You can seek for high paying positions such as pharmacy manager, work night shift, graveyard shift, pick up more hours via PRN position, locum or “moon lighting” etc.

Other ways you can boost your income is to find a suitable side hustle or find a source of passive income to supplement your income.

If you’re stuck at a certain salary and cannot/unable to find other sources of income you can adopt the growing trend of frugality. In other words, live below your means.

The conventional advice is to live like you’re still a college student. In essence, save as much as you can and put your extra savings toward paying off your loans.

I know you’re itching to buy your dream house and luxury car but those things can wait.

According to The Student Loaner, the two best options for pharmacists are:

- Pick an income-based repayment plan and enroll in a PSLF program if you quality

- Stick with the standard plan and throw every penny you have at your loan (my plan)

Credit Card

Another really good strategy to attack your loan is through using credit the smart way. Now, this only work if you’ve only got 10 to 20 thousand dollars left on your student loan.

Remember all those credit card offers you get in the mail? Have you seen offers of 0% APR for 18 months? Most offer will undoubtedly charge a transfer fee so better yet, find one that offers both. Zero balance transfer fee and zero APR for 18 months.

One of my good friend told me that are two kinds of credit card debt. Good credit with leverage and bad credit with no leverage. Well my friend, if you transfer the last of your student loan balance to a credit card that offer what I mentioned above, you could potentially save some serious money on interest fees!

How not to plan for your student loans repayment:

It’s important to make your payments on time. If you miss payments, this is one of the sure way to lead you to a student loan default. Don’t think that this cannot happen to you. I have read about how high income earners who didn’t manage their money appropriately go into loan default.

Default is a sure way to decrease your credit score and negatively impact your finances in the future.

If you made the mistake of buying big ticket items (like I did), then you’re making it that much harder on yourself to be student debt free.

Good luck!

Additional Student Loan Resources for Pharmacists

- Pharmacist Salary: Is It Worth the Debt?

- Your Financial pharmacist student loan The Ultimate Guide to Pay Back Pharmacy School Loansguide

- Student loan repayment for new pharmacists

- Student Loan Refinancing Strategy

- Best Student Loan Refinance Reviews

- Ways to Pay Your Student Loan Faster

- 5 Strategies for Pharmacy School Loan Repayment

- 7 Pharmacist Loan Forgiveness Programs

- 7 Student Loan Repayment Strategies for Pharmacists

- A Pharmacist’s Guide to Student Loan Refinancing

- A Prescription to Cure Pharmacy School Debt

- Ultimate Guide To Student Loan Repayment For Pharmacists

- Pharmacists Student Loan Forgiveness Guide

- How Pharmacists Can Manage Student Loans