Financial Engines Review

In this post, I will review financial engines also known as advised assets group and decide whether or not it is worth it due to their fees and other factors.

What is Financial Engines (FE)?

According to its website, they are founded in 1996. They described themselves as:

We provide objective, fee-based advice and asset management, with an aim to help you build a better financial future, plain and simple.

Financial Engines

Additionally, financial engines touted that they helped manage 9 million retirement accounts since 1996.

Financial engines together with Aon Hewitt conducted a study and concluded that employees got better returns with professional help.

Employees using employer-provided professional investment help had better returns on their 401(k) retirement investments than those who didn’t use help.

This study focused on the use of managed accounts, online advice, and target date funds. It revealed that, on average, median annual returns for employees who got help were more than 3% (332 basis points, net of fees) higher than people who didn’t get help across the six-year period covered by the study

Financial Engines

How does it work?

- Retirement Evaluation

- Personalized Retirement Plan

- Flexible solutions

- Retirement income solutions

Retirement Evaluations

Financial Engines give employees a personalized retirement evaluation based on their current investments and savings decisions along with their age and salary.

The evaluation gives employees a picture of their financial future and where they stand with savings, risk, and diversification.

With all of these factors into consideration, financial engines will create a retirement income forecast to see if you’re on track with your desired retirement income.

Personalized Retirement Plan

This plan includes investment, savings, and retirement income. The plan will offer suggestions for how much to save and when you can retire.

Flexible Solutions

Financial engines work with employees in two ways.

- Professional Management

- Investment Advisor Representatives

With the professional management plan, FE will create, implement and monitor a personalized retirement plan for them for a low monthly fee.

Investment Advisors are available to help with personalized retirement plans and answering questions.

Retirement Income Solutions

FE offer Financial Engines Income+, an extension of professional management, designed to provide monthly payouts from 401 (k) accounts to last for the duration of your retirement.

Additionally, you have access to advisor representatives to help answer other questions.

My own experience with Financial Engines

I used to have a 401 (k) account with Vanguard through my first employer in 2012. I played around with my Vanguard account and came across financial engines at the time.

Reading through its services, it sounded good and I signed up. I will occasionally run a retirement analysis to see where I am at with my retirement income.

Everything usually looks good, I followed FE’s advise and increased my 401 (k) contribution to get the maximum allowable limit for 2019.

Speaking of 401 (k) contributions, I just recently learned that if you exceeded the $19,000 limit you have to withdraw that excess amount before filing your taxes. Otherwise, you will be hit with a penalty.

Is Financial Engines Worth It?

In a sense, Financial Engines work exactly like Betterment. I know that since 2012, I have been paying a significant amount of fees but knowing very little about investment, I thought having a “managed” account is better than managing it myself.

It’s hard to find the exact fee structure for financial engines, luckily, this article has the information I needed.

Financial Engines Fees

The website doesn’t offer information on what Financial Engines costs to an employee, but I was able to contact Mike Jurs, a spokesperson for the company. He said the cost to the employee will depend upon the arrangement the employer has with Financial Engines.

Investor Junkie

A very few employers make the service available to their staff free of charge, but the range is between 0.20% and 0.60% of the value of your retirement portfolio, with the average being “just below 0.40%.” Based on the average, the cost on a $100,000 401(k) plan would be just below $400 per year.

FE costs are in addition to administrative fees associated with the numerous funds my 401 (k) does business with.

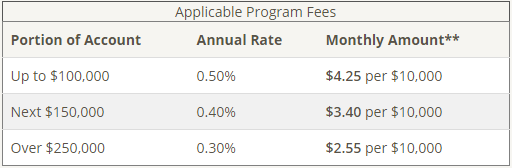

I made the call to cancel my professional managed account with FE today (7/17/19). The representative gave me a few good nuggets I’d like to share with you. My current company has this fee structure with FE. For the first $100k managed by FE, I am charged a 0.50% fee. From $100k to $250k I am charged 0.30% fee. Since my account is not over $250k, the fee for that bracket is not disclosed.

Overall, FE charges an average of 0.49% monthly fee in my case. I’m correct to cancel this arrangement. A 0.49% fee is high, as much as a mutual fund management fee. No Thanks.

FE costs breakdown

| Dates | FE Fees | Funds Fees |

| 7/5/2019 | $109.08 | $7.62 |

| 4/15/2019 | $99.56 | $7.62 |

| 1/14/2019 | $91.12 | $7.62 |

| 10/12/2019 | $92.52 | $7.62 |

Looks like I am assessed a quarterly fee for both fixed funds administration fees plus an additional FE fee. Breaking down the FE fees to monthly fees, that’s around $36 dollars per month. If I were to fire FE today, I’d only have to pay $2.54 per month for the fund’s administration fees.

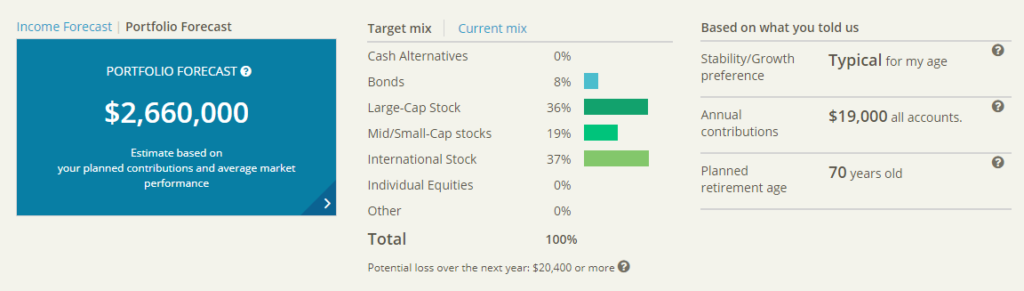

What do I get out of FE? One feature I really like is their forecasting.

FE forecasting breaks down to income forecast and portfolio forecast. I like that I can picture what my retirement monthly income and total portfolio will be when I retire.

FE will automatically allocate my funds based on my risk tolerance and market conditions. The more I look at it, FE looks more and more like a robo-advisor.

For the services that I have been getting and the amount of money from fees, I have to pay since 2012. I don’t think FE is worth it to me.

After publishing this post, I plan on canceling my professional managed retirement accounts and manage it myself.

I can use allocation suggestions from both Betterment and Personal Capital as a guide. Also, you don’t really need to make changes to your allocations a lot.

From what I hear, you only need to perform an allocation change once or twice yearly.

Final Thoughts

I am glad I decided to take a look at my 401 (k) fee structure. It’s always good to have the peace of mind that someone is managing my retirement funds for me, but at the same time, I learned that assessing how much fees you are paying is as equally important.

My 401 (k) is at a modest amount right now, in fact, I am just a little better than my peers in this regard. My current 401 (k) administrator, Empower, has a neat tool that I like. They tell me where I stand in comparison to my peers.

I fall in the category of age 30-39, salary greater than 100k, and is a male. Average peers in my category are contributing 7% of their paycheck and have a balance of $72k,

On the other hand, the top performers are contributing 12% of their paycheck and have a balance of $194k. I still have a lot of work to do.

I thought that by increasing my contributions to 15%, I’d meet the current maximum contribution limit for this year. That would have been true if the 5% employer match is counted.

Turns out, employer contributions don’t count toward your 401 (k) limit. I have to up my contributions to 20% to maximize my contributions for this year.

I’m probably going to have to reassess and see if my 20% for next year is exceeding the yearly limit.

Do you have an account managed by Financial Engines? Are you keeping it or canceling it? Let me know but commenting below!