A Comprehensive Guide on How to Buy a House

Purchasing a house is one of the most significant financial decisions you’ll make in your lifetime. It’s a process that requires careful planning, research, and attention to detail. Whether you’re a first-time buyer or a seasoned homeowner looking for a new property, this guide will walk you through the essential steps to buy a house. 1. Assess Your Financial Situation

» Read moreTips for Protecting Your Future and Finances as a Young Adult

Navigate your financial journey with the expert advice and investment tips available on Pharmacist Money. Discover comprehensive guides tailored to your unique financial challenges and start building a prosperous future today. Tips for Protecting Your Future and Finances as a Young Adult Photo by Freepik Stepping into independence brings a mix of thrill and trepidation. As a young adult, the choices you

» Read moreA Comprehensive Guide to Investing in Alternative Assets

Introduction When it comes to investing, most people think of traditional assets such as stocks, bonds, and real estate. However, there’s a whole world of alternative assets that offer unique opportunities for diversification and potentially higher returns. Alternative assets include a wide range of investments, from precious metals and collectibles to private equity and cryptocurrencies. This article aims to provide

» Read moreA Comprehensive Guide on How to Invest in Real Estate

Introduction: Investing in real estate can be a lucrative venture, offering potential for capital appreciation, rental income, and portfolio diversification. However, it requires careful planning, research, and a solid understanding of the market. In this article, we will walk you through the essential steps to successfully invest in real estate. 1. Define Your Investment Goals: Begin by clarifying your objectives.

» Read moreThe Art of Frugality: Living a Fulfilling Life with Less

In a world that constantly encourages consumerism and the pursuit of material possessions, embracing frugality might seem like a countercultural choice. However, the practice of frugality is not about living a life of deprivation or scrimping on essentials. Instead, it is a mindful approach to managing resources, prioritizing what truly matters, and finding joy in the simplicity of life. Understanding

» Read moreAccelerating Debt Repayment: Strategies for the Fastest Route to Financial Freedom

Introduction Debt, though sometimes unavoidable, can weigh heavily on an individual’s financial well-being. Whether it’s student loans, credit card debt, a mortgage, or any other type of debt, finding the fastest way to pay it off can provide a sense of relief and pave the path to financial freedom. This article delves into effective strategies to expedite debt repayment and

» Read morePractical Strategies to Save Money and Secure Your Financial Future

Introduction In an era of rising costs and economic uncertainties, learning how to save money has become an essential skill. Whether you’re aiming to build an emergency fund, pay off debt, or achieve long-term financial goals, adopting effective money-saving strategies can greatly impact your financial stability. This article will delve into practical and actionable tips to help you save money

» Read moreBuying a Used or New Car: Making the Right Choice

Introduction The decision to buy a car is a significant one that involves careful consideration of various factors, one of the most important being whether to opt for a used or new vehicle. Both options have their own set of advantages and disadvantages, and making the right choice depends on your individual preferences, budget, and priorities. In this article, we

» Read moreA Comprehensive Guide on How to Pay Off Your Student Loans

Introduction The burden of student loans can be overwhelming, but with careful planning and dedication, you can successfully pay them off and pave the way for a financially secure future. This article provides a comprehensive guide on various strategies and tips to help you efficiently pay off your student loans. 1. Understand Your Loans The first step to tackling your

» Read moreExploring Diverse Investment Assets: A Guide to Building a Balanced Portfolio

Introduction In the ever-evolving landscape of investment opportunities, understanding the range of assets available is essential for investors seeking to maximize returns while managing risk. Diversification is a key strategy for building a resilient investment portfolio, and this involves allocating funds across various asset classes that have different risk and return profiles. In this article, we will delve into different

» Read moreRenting vs. Owning: Making an Informed Decision for Your Home

Introduction: Deciding whether to rent or own a home is a significant financial and lifestyle choice that deserves careful consideration. Both options come with their advantages and disadvantages, and the decision depends on various factors, including your financial situation, long-term goals, and personal preferences. This article aims to provide an objective overview of the pros and cons of renting and

» Read moreThe Art of Investing: Navigating the Path to Financial Prosperity

Introduction Investing, a cornerstone of building wealth and achieving financial freedom, is both an art and a science. It’s a journey that requires patience, discipline, and a clear understanding of the market dynamics. Whether you’re a novice looking to dip your toes into the investment waters or a seasoned pro seeking to refine your strategies, mastering the art of investing

» Read moreIntroduction to Credit Card Debt

Credit card debt can be a significant burden for many individuals. When used responsibly, credit cards can be a useful financial tool, offering convenience and access to credit when needed. However, when not managed correctly, they can lead to significant financial stress. This article aims to provide a comprehensive guide on how to pay off credit card debt, offering practical

» Read moreHow Entrepreneurs Can Overcome Financial Setbacks

How Entrepreneurs Can Overcome Financial Setbacks For those with an entrepreneurial spirit, there is no greater source of fulfillment than starting up a dream business. While it has become increasingly easy to begin operating a business out of the comfort of one’s own home, that doesn’t change the fact that being an entrepreneur is something of a gamble. Statistics show

» Read moreTips for Launching a Successful Health and Wellness Business

Photo via Pexels Tips for Launching a Successful Health and Wellness Business There’s a lot of money to be made in the health and wellness industry. At Pharmacist Money, we know this first-hand! Whether you’re interested in launching your own pharmacy business, personal training studio, nutritional coaching service, or local health food store, running a health-based business is a fulfilling

» Read moreHelping Someone With Cancer

Image via Pexels Helping Someone With Cancer Illness can affect anyone regardless of age or gender, and cancer is considered one of the worst. So many types of cancer are challenging to those who fight it. It is a battle no one should face alone. There are ways you can help; you don’t have to be a doctor or scientist

» Read moreHow to Cope After Being Diagnosed With a Chronic Illness

Image Source: Pexels How to Cope After Being Diagnosed With a Chronic Illness Being diagnosed with a chronic illness can disrupt your life in countless ways. For instance, your illness can restrict physical movement, affecting your ability to independently do chores. That means you will need to learn how to manage pain and take care of your mental wellbeing. Additionally,

» Read moreMoney Matters For Your Business – Here’s Why

The Pharmacist VS Money blog has discussed personal financial freedom in the past. But, if you own a business, you also have to prioritize your company’s financial health. This is an involved process that includes everything from forming the right business structure to creating a budget and honing your own skills. Today, we share tips on how to keep your

» Read moreHow to Save Money for a Car?

HOW TO SAVE MONEY FOR A CAR? A car is a large purchase, and you may not want to take out a loan for the entire amount. Before you go car shopping, discover how to save money for a car by making a budget, comparing different automobiles, and putting in place methods to make saving easier. What are some ways

» Read more5 Steps to Financial Freedom

In today’s post, I will discuss five steps you can follow to pursue financial freedom also known as financial independence. 1. Pay off your debts Why do you have to pay off your debts? You might ask yourself, don’t you need debt to get rich? How can you go anywhere without getting into debt? Yes while it is true that

» Read moreWhy am I pursuing financial independence?

Financial independence, retire early (FIRE) is a personal finance movement that started around 10 years ago. What is inancial independence, retire early (FIRE)? What is financial independence (FI)? At its root, financial independence is achieved when you are no longer dependent on anyone including your current job to support yourself financially and maintain your current lifestyle. How can you achieve

» Read moreFIRE Options for Pharmacists

Can the FIRE movement be an option for pharmacists? FIRE stands for financial independence (FI). retire early (RE) and is a great option for pharmacists facing burnout. According to the American Pharmacist Association, a survey from more than 2,000 pharmacists showed that 30% are in the “high distress” category, which makes it more likely that they will experience pharmacist burnout,

» Read moreHow I became a net worth millionaire

In this post, I will share with you how I become a net worth millionaire. My current net worth It has been a while since I provided you with my net worth update. The truth is I haven’t been entirely honest with you. I have only been counting my portion of assets and liabilities but excluded my wife’s. My current

» Read more10 Perks of Being a Pharmacist

If you are at that point in life where you have to decide on a career that grants you financial stability andmental satisfaction, Pharmacology is a promising field to step into. If the medical industry is your niche,but you are not inclined to becoming a doctor or surgeon, being a pharmacist is a decent alternative.Pharmacists are less likely to be

» Read moreHow I Invested my HSA

An HSA is one of the best-kept secrets out there because of its versatility. My current employer offered an HSA back in 2016 but I brushed it off to opt-in for the PPO plan. In 2019 when I did more research into what an HSA is and how it was helpful to the future financial goals I was determined to

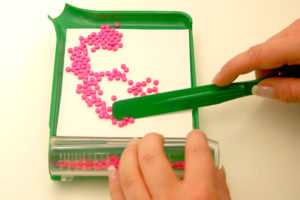

» Read moreWhat can my FSA card buy?

An FSA or a flexible spending account is an arrangement set up by your employers to help you pay for qualified medical and dental expenses. Funds contributed to your FSA account are deducted from your paycheck and are not subject to income and payroll taxes. The funds can be used like a debit card for qualified expenses and are not

» Read moreCheapest Pharmacy Schools in America

It pays to get your PharmD from the cheapest pharmacy school you can find. As a pharmacist, the number one thing that keeps me up at night is the balance of my student loan. As an aspiring pharmacist, you can make this one decision that can affect your financial well-being many years down the road. You can choose to go

» Read moreWhat’s in my Roth IRA Account?

I made my first backdoor Roth IRA mistake and I’ll share it with you in this post along discussing my portfolio strategy for my Roth IRA account. Backdoor Roth IRA Before diving into how and what I am investing inside my Roth IRA account, I wanted to share with you my first mistake when contributing to a Roth IRA account.

» Read moreDon’t be a pharmacist HENRY!

What is HENRY? High earner, not rich yet (HENRY) is a term a came across with reading an article. Investopedia states that a 2003 Fortune Magazine article defined families earning between $250,000 and $500,00, but don’t have much to show for it after taxes and costs of living. This term is applicable to professionals such as lawyers, doctors, dentists, and

» Read more10 Ways to Boost Earnings for pharmacists

10 Ways to Boost Earnings for pharmacists What if you love what you’re doing as a pharmacist but you’re looking for ways to boost your earnings as a pharmacist? Here is the list of ways you can improve your earnings as a pharmacist. Start a side hustle, These side hustles can be related to your pharmacy skills set or it can

» Read moreWhich are the best Texas cities to live in?

You’ve probably have heard of more people moving to various Texas cities lately where there seems to be an exodus of people and companies becoming more interested in the state. I read an article that piqued my interest in this topic. LinkedIn came out with a report ranking the top cities with the most newcomers and Austin, TX was ranked

» Read moreFundrise Review: Real Estate Crowdfunding

How Does Fundrise Work? Fundrise takes commercial projects across the states and turns them into Electronic real estate investment trusts (eREITs). This is in contrast to regular REITS whether privately or publicly traded REITS. You can think of this as similar to an index fund where each eREITS is a basket of various commercial real estate projects. Fundrise has declared

» Read moreSocial Media Content Ideas for your Business

The most challenging part of running a social media campaign is fresh social media content ideas. Great social media content is very important for the growth of your brand. However, you are expected to be consistent in providing high-quality content across your social media channels. It can be tough, and to help you, I have provided a few social media

» Read moreMoney Moves to Make Before Year’s End

In this post, I will cover some of the most important money moves you need to take at the end of the year. It is always a good idea to monitor your personal finances throughout the year. As we are heading toward the end of the year it’s equally important to work on certain things and make plans for the

» Read moreBranding Your Passive Income Business

Simple Steps for Branding Your Passive Income Business Sometimes it’s nice to have an extra source of cash flow. Maybe it’s for a new home. Or to save for your daughter’s college tuition. The whole idea of a passive income is that it’s your side project. Flexibility with it is essential. This is why a lot of people opt to

» Read moreCan Pharmacists Retire as 401k Millionaires?

Can pharmacists retire as a 401k millionaire? The answer is a resounding yes! In fact, non-pharmacists can become 401k millionaires as well. Let’s find out how! 401K Millionaires It turns out American millionaires have a lot of things in common. According to a survey conducted by Ramsey Solutions from personal finance expert, Dave Ramsey found out that: 79 percent didn’t

» Read more6 Best Low-Cost Index Funds

Low-Cost Index Funds When it comes to investing, for the majority of people, low-cost index funds are the way to go. Low-cost index funds offer the following advantages. An index fund is like a basket of stocks that you can buy into. When you buy a share of that fund, you own a small portion of the basket of stocks.

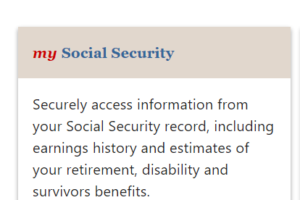

» Read moreWill Social Security be there for me when I retire?

My Social Security Social security is an important component of retirement planning. As such it is a good to question its sustainability. First off, since social security is important it’s a good idea for you to create an account to monitor and utilize the resources afforded to you from the social security website. The government’s social security website give you

» Read more6 Financial Mistakes to Avoid

Everyone makes mistakes, all kinds of different mistakes and financial mistake is one of them. In this post, I will list all past mistakes that I made and I hope that you can learn from them and to avoid making the same mistakes that I did. Financial Mistake #1: Racking up Credit Card Debts Everyone has credit card debts but

» Read moreHow Much Money Do Pharmacists Make?

How Much Money Do Pharmacists Make? In this post, I will explain why how much money a pharmacist make does not matter and what you should focus on instead. First off, let’s acknowledge that money is important. Numerous studies have shown that in fact, money does bring happiness. A study published recently found that among people age 30 and older,

» Read moreWealthy vs Rich: The Key Difference

Wealthy vs Rich Is there a difference between being wealthy vs rich? As it turns out, there is a key difference between the two, and I will discuss it with today’s post. In 1997, Robert Kiyosaki published a personal finance book called Rich Dad, Poor Dad. The book instantly became a phenomenal success and in no time catapulted Kiyosaki to

» Read moreDoes 7 Baby Steps by Dave Ramsey Work?

Dave Ramsey’s 7 Baby Steps Dave Ramsey is a well-known money expert, he has written numerous personal finance books and is best known for his 7 baby steps. By the way, if you haven’t read his book: The Total Money Makeover, I highly recommend it! 7 Baby Steps Baby Step 1. Save $1,000 for your starter emergency fund. Baby Step

» Read moreThe 6 Best Vanguard Funds to Buy Now

Vanguard funds are well known for its low-cost and broad diversity, in this post, I will list the best Vanguard funds you should buy and hold. Vanguard offers a variety of index funds and exchange-traded funds (ETF). Why Vanguard Funds? Vanguard offers 75 ETFs and 160 mutual funds to choose from. Which Vanguard funds should you buy? You should buy

» Read moreMy 6 Sources of Passive Income

I personally believe it is important for pharmacists to have different sources of passive income. Why? It is one of the best ways for pharmacists to achieve financial freedom and choose to work on your own terms. We all know the high demand and stress of being a pharmacist. Wouldn’t it be nice to cut back on your hours by

» Read moreWhen Should I Buy a House?

In order to know when is a good time to buy a house, you need to look into the costs associated with buying and own a home and other factors. In this post, I will discuss all the factors associated with buying a house and the costs associated with buying and owning a home. What are the costs associated with

» Read moreAverage Pharmacist Salary in 2020

How did pharmacist salary change in 2020? In this post, I will visit popular pharmacist salary databases to determine the average latest pharmacist salary numbers. Pharmacists are among the many essential workers out there working during the pandemic. They work during the day, night, weekends, and holidays providing important healthcare need to the American people so their compensation is justifiable.

» Read moreHow to Get Rich Slowly as a Pharmacist

Lately, I’ve been thinking a lot about how pharmacists can build wealth and I’ve come to the conclusion that getting rich slowly is the key. You’ve heard it on the radio, you heard it on television, or perhaps read it in a blog just like this one-uncover this secret, buy this and that to get rich quickly! That is not

» Read moreThe Definitive Guide for Pharmacist Jobs

Pharmacist Jobs Projection One of the reasons why I got into a career in pharmacy is the plethora of pharmacist jobs and the career opportunities available. When I matriculated into pharmacy school, the jobs market looked differently then what it is now. According to the bureau for labor statistics (BLS), job growth for pharmacists is at 0% with little or

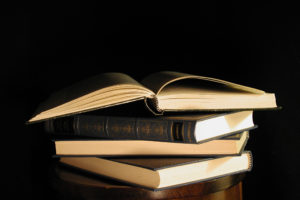

» Read more7 Finance Books that Changed My Life

In today’s post, I will list seven different finance books that may change your life completely if you take the time to read or listen to them. I highly recommend that you do so! I have paid hundreds of dollars purchasing these books and others in order to broaden my knowledge and understanding of personal finance. These seven books definitely

» Read moreShould I open a 529 plan?

A 529 plan is a great tool for saving for college. So should you open a 529 plan for your loved ones? According to NerdWallet, there are two different kinds of 529 plans. 529 Savings Plan 529 prepaid plan 529 college savings plans are the most common type. Investments grow tax-free and can be withdrawn tax-free for educational expenses like tuition,

» Read moreCan you earn money from Youtube?

Can you earn money from YouTube? Can you earn money from Youtube? Have you ever wonder how much money YouTubers earn? I wondered about it too, but today my friends, I have some data to share with you! First let’s start off by offering some basic regarding how you can start to earn money from YouTube. You have accumulated 240,000

» Read moreHow much cash cushion do you need?

How much cash cushion do you need? In light of the recent current pandemic that’s creating an economic uncertainty, a cash cushion is crucial to your financial health. First, let’s discuss the difference between a cash cushion versus an emergency fund. According to the balance: In general, a cushion is a small balance (less than $1,000) that you maintain in your checking

» Read moreYour Mortgage Price: The Determining Factors

What You’ll Learn There’s no one biggest factor in determining mortgage price There are many factors that help lenders set interest rates Some of the factors are within your control There are a lot of different factors that decide the price of your mortgage. Some factors depend on you, the homeowner. Some depend on the particular property you have in

» Read moreBest Pharmacy Schools in 2020

US News and World report released it’s best pharmacy schools list in 2020 recently. Are you an aspiring pharmacist and wanted to do research on your prospective pharmacy schools and wanted to see which school or colleges of pharmacy best fit your needs? Usually finding out the rankings of pharmacy schools is a good place to start when I am

» Read moreTax Loopholes You Should Know

Recently I came across an article discussing legal tax loophole in the states. It’s an article from MSN and for some reason, they love slideshow. I’m going to summarize some of my favorite tax loopholes discussed in this article in one post to save you from all that clicking! Tax Loopholes The internal revenue services (IRS) allow for legal tax

» Read moreThe top 10 most reliable cars

Have you ever wondered if the car you’re driving is a reliable car? I love my Honda and think they’re one of the most reliable cars out there. But is my trust in Honda misguided or is there some truth in that? Let’s find out! Top 10 Most Reliable Cars Who made it to the top 10 most reliable cars?

» Read moreThe Pharmacy Disruptor

Who is the pharmacy disruptor? In this blog post, we’ll take a look at who is the most promising pharmacy disruptor to date. Every industry has its own disruptors, in the technology sector you’ve got Facebook, Google, and YouTube leading the way. Pharmacy is an old industry long dominated by brick and mortar stores. They generate their revenue from dispensing

» Read moreAre You Ready to Buy Your First Home?

Are You Ready to Buy Your First Home? Many renters opt to remain renters for a long time for different reasons. Some of them value the flexibility of having a landlord take care of some of the headaches that come with living in a house or apartment. Others find it convenient to be able to relocate to another place with

» Read moreDecember 2019 net worth update

I can’t believe it’s already time for the December 2019 net worth update! My last net worth update was back in August 2019. I have made some good progress on my investments and savings but I’ve learned and accepted that market conditions will derail some of my progress. August 2019 net worth recap My first net worth update was back in

» Read moreBackdoor Roth IRA

What is a backdoor Roth IRA? In today’s post, I will discuss my experiences with my first backdoor Roth IRA and a subsequent step-by-step guide. In my opinion, Roth IRA is one of the most versatile tax-advantaged retirement account you can take advantage of today. If you’re interested, I discussed in more detail about Roth IRA in another post and

» Read moreHSA with Optum Bank

Three years ago, my current employer introduced a health savings account (HSA) as an option for my medical benefit. I briefly went over the plan but ultimately chose a PPO version. It’s not until recently that I discovered that HSA plans offer so many benefits and can be used as my third tax-advantaged plan. Some even called the health savings

» Read more401 k vs Roth IRA

In this post, I am going to compare a Roth IRA versus a 401k plan and recommend which one is better for you in your situation. What is a Roth IRA and 401k? Roth IRA (Individual Retirement Account) is essentially a self-directed retirement account. A 401k, on the other hand, is an employee-sponsored retirement account. These are two main ways

» Read moreHow to Invest in Real Estate

There are many ways to invest in real estate. In today’s post, I am going to go over 5 ways to invest in real estate. Real estate can be argued as a part of a well-balanced investment portfolio and is a good asset class for diversification. Investment in Real Estate-traditional route Traditional real estate investment is self-explanatory. You acquire a

» Read moreTerm vs whole life insurance

In this post, I am going to discuss the differences between term life insurance and whole life insurance. Insurance is one of those things in life that’s necessary because of life’s uncertainties. I could finish this post, go outside for a walk and get hit by a car, and that’s all it takes. Most likely we’re all eventually going to

» Read moreI Will Teach You to be Rich Summary

In this post, I will go over the top five takeaways from Ramit Sethi’s book: I will teach you to be rich. I will teach you to be rich Becoming rich isn’t something that only happens to Ivy League graduates, elite athletes or lottery winners. Anyone can become rich. What you need to do is to define what being rich

» Read moreShould I pay off debt or invest?

Today we’re going to talk about the controversial topic of pay off debt or invest? The fundamental question is should you pay off your debt first or should you take that money and invest it? Debt is bad Debt sucks! Debt is the worst! There’s definitely good debt and there’s definitely bad debt. In general, most people don’t want to

» Read moreThink and Grow Rich Summary

This is the top five takeaways summary of Think and Grow Rich by Napoleon Hill. No matter which track you choose to follow in order to get rich. Becoming a trader, a value investor, a real estate pro, a chief executive or perhaps an entrepreneur, you must have the correct mindset. Due to the law of averages, some people may

» Read moreHow to create a debt reduction plan

Today’s guest post on how to plan a realistic budget and create a debt reduction plan comes from Catherine, a freelance writer. How to plan a realistic budget and create a debt reduction plan Are you struggling to repay debt? Don’t worry! Continue reading to know about what to consider when you’re planning a budget and how to create a

» Read moreTips for How to Save Money

In this blog post, I will list 18 tips for how to save money fast! There are many good reasons to start saving money. Maybe you suddenly got slammed with an unexpected bill, or maybe your friends just invited you on a trip of a lifetime. Or perhaps, you want to buy a house and you have to save for

» Read moreBest investing apps in 2019

What are the best investing apps out there in 2019? When it comes to investing, yup, you guessed it right, there’s an app for that! In traditional investing, you need a couple of thousand dollars to get started with either through ETFs or index mutual funds. Enter micro-investing apps. In today’s high-tech world, there are easier ways for you to

» Read moreAverage net worth by age and August 2019 update

In this post, I wanted to look at the average net worth by age in more detail and provide you with an update of my net worth as of August 2019. Let’s start by reviewing some basics. The average net worth for an American to consider wealthy is $2.27 million according to Charles Schwab. Net worth means assets minus liabilities,

» Read moreHow to prepare for a recession

In today’s post, I am looking at what are the causes of and how to prepare for a recession. Our economy is cyclical, we have had times of great economic prosperity for the past 10 years. Eventually, we will have a contraction, where we see unemployment rates go up, consumer confidence fall and possibly leading to a decline in GDP.

» Read moreThe Intelligent Investor Summary

The Intelligent Investor In today’s post, I will summarize and discuss the top takeaways from the book, “The Intelligent Investor” by Benjamin Graham. Warren Buffet, one of the most successful investors the world has ever known has this to say about the book. The best book on investing, ever written. Warren Buffet Investment vs. Speculation Graham defines investment as: One

» Read moreThree fund portfolio: asset allocation

If you have been keeping track of the stock market’s volatility lately, like most investors, you’ll probably want to take a peek your portfolio, asset allocation, and performance. Particularly, if you’re a fan of the three-fund portfolio, you’d wanted to know how it’s performing and make sure that you have the ideal asset allocation. I recently finished listening to The

» Read moreHow much car can I afford?

You may already own a car, and know somewhat the costs associated with car ownership. But have you ever asked yourself this question: how much car can I afford? In this post, I’ll discuss the 20/4/10 rule and how it applies to the process of buying a car. If you can afford to buy a car with cash that’s the

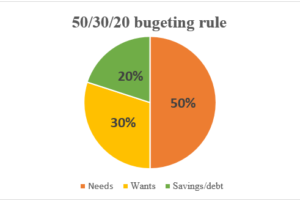

» Read more50/30/20 budgeting rule of thumb

What is the 50/30/20 rule budgeting rule One of the most important things in personal finance is to get intimate with your expenses and have a budget in place. And one of the simplest budgeting rules of thumb is the 50/30/20 system. Senator and Democratic presidential candidate Elizabeth Warren coined the 50/30/30 rule in her book “All Your Worth: The

» Read moreThe cost of car ownership

What is the true cost of car ownership? Believe it or not, owning a car is expensive. You probably already know that but do you know what’s the real cost of car ownership? An article from MSN shed light on the average cost of a car. Car gurus estimate the average cost to operate and maintain a car is $9,576

» Read moreThe Richest Man in Babylon Summary

Continuing with my book review series, in this post I will summarize and showcase the top 5 lessons from The Richest Man in Babylon by George S. Clason. It’s true that money principles derived thousands of years ago can still be relevant and applicable today. Let’s dive into the top 5 takeaways from this book. Richest Man in Babylon Lesson

» Read moreWhat is the routing number of Wells Fargo?

I have to confess, I have to Google the routing number to Wells Fargo every time I needed it. I have been with Wells Fargo since 2002 so that’s a lot of Googling! That is why I am creating this post for my own reference and you’re welcome to use it as well. History of Wells Fargo Wells Fargo is

» Read moreThe Financial Literacy Test

Ever wonder how financially literate you are? Take the financial literacy test here and find out! The quiz is from The National Financial Capability Study (NFCS) is a project of the FINRA Investor Education Foundation (FINRA Foundation). For your convenience, here are the questions: Financial Literacy Test: Question 1. Suppose you have $100 in a savings account earning 2 percent

» Read moreAverage 401k balance by age

How does your 401k balance compare to your peers? Tax advantage plans like 401k and Roth IRA are one of the simplest and best ways to invest for your retirement. Do you wish to know how much you need to contribute? What is a 401k? A 401k is an employer-sponsored retirement plan. Employees can automatically deduct a portion of their

» Read more7 Types of Income Streams

7 Types of Income Streams It is often said the average millionaire has 7 types of income streams. The average person typically has 1 stream of income, usually from their job, and this can put them in a vulnerable position financially. If you take a look at the average millionaire, it is true that they have multiple streams of income-generating

» Read moreDigital Passive Income Ideas

In this post, we’re going to focus on top digital passive income ideas that you can start today. While there are hundreds of ways to earn passive income, the focus of this post is on five actionable digital passive income ideas for busy professionals. So-called internet gurus are painting the picture of you sipping mai tais on the beach with

» Read moreMillionaire Next Door Summary

I just finished listening to The Millionaire Next Door by Thomas Stanley on audible and I want to share with you some of its key takeaways. The Millionaire Next Door When you think of a millionaire, did you think of the people living on the Upper East Side in New York City or the residents of Beverly Hills California? The

» Read moreFinancial Engines Review

In this post, I will review financial engines also known as advised assets group and decide whether or not it is worth it due to their fees and other factors. What is Financial Engines (FE)? According to its website, they are founded in 1996. They described themselves as: We provide objective, fee-based advice and asset management, with an aim to

» Read moreEarly Mortgage Pay off or not?

I will have paid off my student loan at the end of July 2019. My next major financial action is an early mortgage pay off. Early Mortgage Pay off Strategy Early Mortgage Pay off using HELOC Surveying the inter-web there are many options and strategies in which to to pay off my mortgage early. The first option I stumbled upon

» Read moreInteresting Personal Finance Articles

Enjoy this week’s top financial articles from the likes of Forbes, Fortune, etc. 10 Money Mistakes to Avoid in Your 30s From a financial standpoint, your thirties are the most critical decade of your life. By avoiding the items on this list you’ll radically improve your financial future and even position yourself for early retirement. High-Earning Millennials Have a Debt Problem!

» Read moreVanguard Index Funds Strategy

Continuing on my investing series, in this post I will show you exactly the strategy on how I will invest in Vanguard Index Funds. Advantages of Vanguard Index Funds Investing in index funds might the best, easiest, safest long term investment out there for most people. It’s one of my favorites ways to invest. This investment strategy requires very little

» Read moreHow to Invest Money Wisely

Step by Step on How to Invest Your Money In the post, I will show you exactly how to invest money in seven steps. Starting with the lowest risk and progressing to higher risk forms of investment. How to invest Money Step 1: Low-Risk Investment Here, you’re looking for a basic place to put your money. The number one choice

» Read morePharmacist House: How Much Is Ideal?

Pharmacist House: How much house can a pharmacist afford? I currently own, have a mortgage on a home and I want to retrospectively go back in time as a new pharmacy graduate and crunch some numbers to see what is a good price point if a pharmacist wanted to buy a house. I will also discuss if it is a

» Read moreIs a Pharmacist CV Necessary?

You are familiar with a resume but you may or may not be too familiar with a pharmacist cv (curriculum vitae). This post will guide you on the best practices on how to write a pharmacist CV and resume based upon my own experiences and research. What is a Pharmacist CV? A summary of a job applicant’s professional experience and

» Read moreThe Fiverr Millionaire

What is Fiverr? Is Fiverr a viable side hustle? Apparently, it is, you can earn a lot more than $5, in fact, you can be a Fiverr Millionaire! In this post, I will summarize how four individuals were able to scale their Fiverr freelancing work and earned seven figures to become a millionaire in the process. Fiverr is a global online

» Read moreRich Dad, Poor Dad Summary

I signed up for a free trial of Audible and got a free audiobook. Due to the high recommendations from friends and other personal finance bloggers, I chose Rich Dad, Poor Dad as my starter audiobook. As a busy pharmacist, while maintaining a nascent blog, I find myself with less and less time. I turned to podcasts and now Audible

» Read moreBetterment Review: Invest and Savings

I opened an account with Betterment 7 years ago in 2012. In this blog post, I will document my experience with Betterment. Betterment along with Wealthfront are the two best and most well-known of the so-called robo-advisers. They are called robo-advisors because they decided to cut the human middle man out of the equation and instead relied on its own

» Read moreSunday personal finance reading

Enjoy the current edition of the Sunday reading for pharmacy professionals, which features interesting articles and topics from the world of personal finance. Average 401(k) Balance by Age The average 401(k) balance may be at an all-time high, but you’ll likely be surprised to see just how low that number actually is. View the chart to see how you compare

» Read moreWhat’s my Net Worth in May 2019?

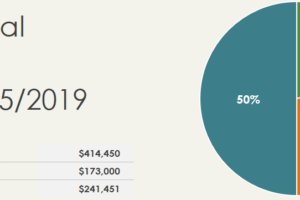

What’s my net worth in May 2019? When I graduated from pharmacy school in 2011, I had a negative net worth of $218,000 with a combination of student loan and credit card debts! It has been a humbling experience clawing my way of that debt to having a net worth of $241,451 at the end of May 2019. I was

» Read more19 Podcasts Pharmacists Should be Listening to Today

Podcasts have been around for a while now, a quick google search has podcasting, known then as audio-blogging starting as early as 2004! Like most pharmacists, I commute to and from work every day. You’re lucky if your commute is less than 30 minutes per round trip! I have done it all, at first I was listening to music, but

» Read moreFinancial advice for the first year pharmacist

Congratulations! After four years of hard work filled with sweat, and tears, you graduated from pharmacy school! You’re ready to conquer the world but what’s next? Hopefully, you didn’t have a hard time passing your NAPLEX or MPJE exams. Now that you’re officially a pharmacist and started a job, how are you going to deal with your personal finance? I

» Read morePharmacists on FIRE, is it possible to retire early?

What is FIRE? FIRE is a fairly new phenomenon, it stands for Financial Independence, Retire Early. The financial independence movement started about 5 to 10 years ago. I only learned of the FIRE community when I read news articles discussing about Mr. Money Mustache and other millennials retiring in their thirties. Recently, Your Financial Pharmacist blog posted a really good

» Read moreSofi Money Review

High-yield savings are a fantastic way to stash your free money wasting away in your checking account. This Sofi Money Review will go over the pros and cons of opening an account with Sofi Money. You typically earn an average of 2.20 % APY or more dependent on which savings account you pick. One of the problems with keeping cash

» Read more